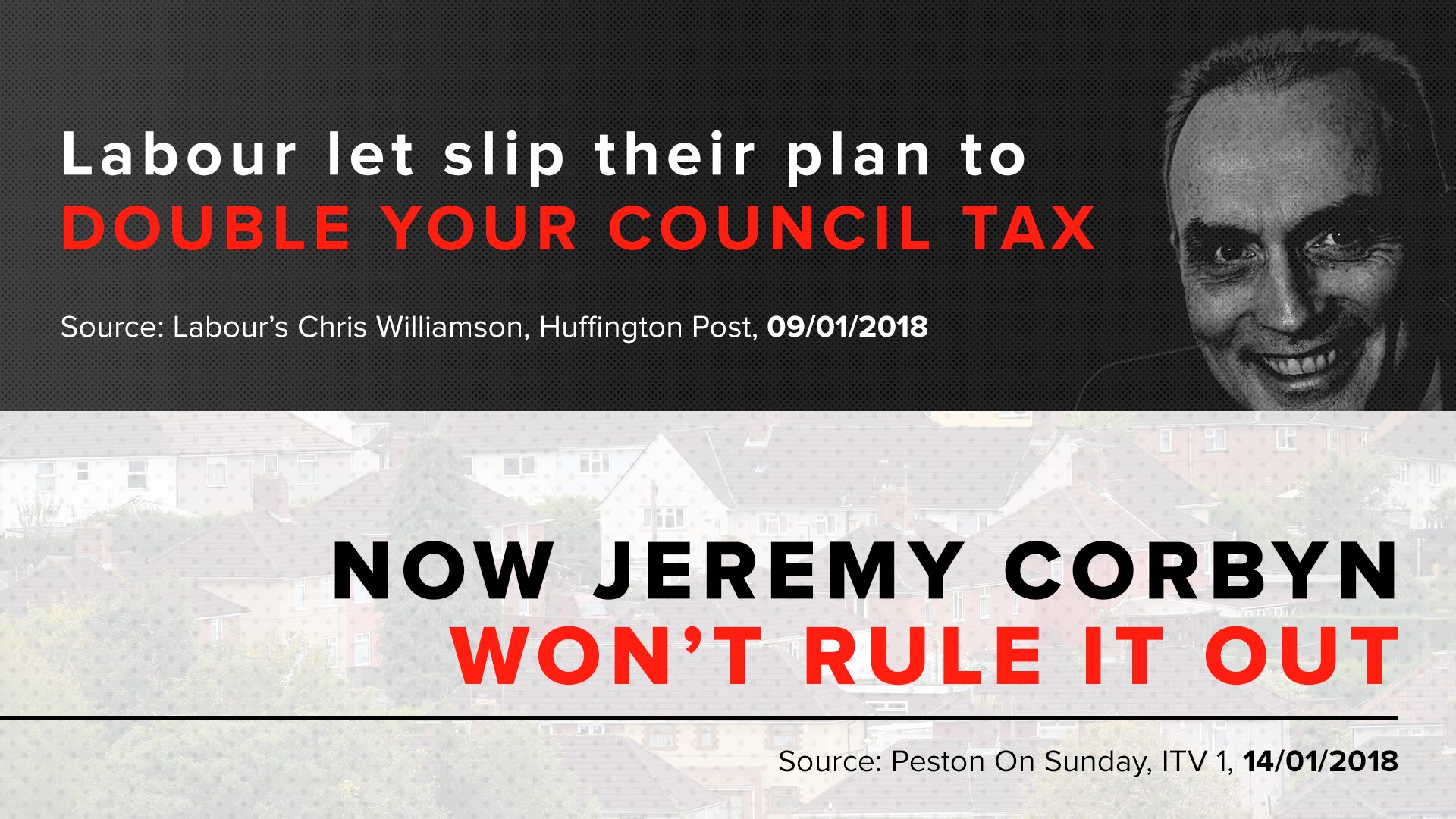

Jeremy Corbyn refused to rule out hiking council taxes, after Chris Williamson let slip Labour’s plans last week. Labour always raise taxes if they get into power, and it is working people who pay the price.

Key facts: Last week Chris Williamson revealed Labour’s plans for a dramatic increase in Council Tax. He then had to resign from the front bench, but over the weekend Jeremy Corbyn refused to oppose his proposals.

- In an interview with the Huffington Post, Williamson set out Labour’s plan for what he called a ‘Differential Progressive Council Tax’. This would mean those in homes in band D or above facing a sliding scale of Council Tax increases by 20 per cent per band, with up to an 100 per cent increase for the highest band H.

- A Labour source told The Times that Williamson was asked to leave the front bench because Mr Corbyn was worried about angering wealthy voters in his constituency.

- It is unsurprising that Mr Corbyn has refused to rule out these plans. Under the last Labour government, Council Tax bills doubled, and Labour’s manifesto contains plans to replace Council Tax with a new Garden Tax which would also mean significant tax increases.

Why this matters: Labour can’t be trusted when they claim that they will not raise taxes for ordinary working people. From Whitehall to the town hall, Labour in power always means more debt, higher taxes and fewer jobs, and it’s working people who pay the price.

What it could mean here in the Chorley constituency:

We've looked at Chorley's council tax bands and here's what such a plan would mean:-

-

Band D £1,641 increasing to £1,969 +20% +£328

-

Band E £2,006 increasing to £2,808 +40% +£802

-

Band F £2,371 increasing to £3,794 +60% +£1,423

-

Band G £2,735 increasing to £4,923 +80% +£2,188

-

Band H £3,282 doubling to £6,564 +100% +£3,282

Illustration of the number of homes hit by an increase ranging from 20% to doubling should a Williamson plan of the left be implemented:-

CHORLEY CONSTITUENCY BY TOWN AND PARISH

|

Community |

Number of Homes across Council tax Bands D to H |

% of all homes hit by the plan if implemented |

Today's average council tax for homes from Band D to Band H |

Williamson's plan for Council Tax (Average across Bands D to H) |

Average increase for Band D to H |

|

Adlington |

542 |

19% |

£ 1,956.32 |

£ 2,734.41 |

40% |

|

Anderton |

250 |

42% |

£ 1,968.92 |

£ 2,782.89 |

41% |

|

Anglezarke |

13 |

100% |

£ 2,426.98 |

£ 3,989.79 |

64% |

|

Astley Village |

483 |

34% |

£ 1,889.83 |

£ 2,557.40 |

35% |

|

Brindle |

240 |

55% |

£ 2,082.11 |

£ 3,101.13 |

49% |

|

Charnock Richard |

345 |

43% |

£ 1,964.89 |

£ 2,777.28 |

41% |

|

Chorley |

2886 |

17% |

£ 1,842.45 |

£ 2,452.00 |

33% |

|

Clayton-le-Woods |

2180 |

32% |

£ 1,889.17 |

£ 2,570.81 |

36% |

|

Coppull |

475 |

13% |

£ 1,812.61 |

£ 2,389.45 |

32% |

|

Cuerden |

19 |

43% |

£ 1,958.13 |

£ 2,787.45 |

42% |

|

Euxton |

2064 |

39% |

£ 1,926.07 |

£ 2,670.99 |

39% |

|

Heapey |

247 |

64% |

£ 2,076.27 |

£ 3,039.38 |

46% |

|

Heath Charnock |

447 |

50% |

£ 2,091.39 |

£ 3,101.68 |

48% |

|

Heskin |

201 |

52% |

£ 2,036.06 |

£ 2,975.16 |

46% |

|

Hoghton |

242 |

67% |

£ 2,086.01 |

£ 3,080.48 |

48% |

|

Rivington |

38 |

81% |

£ 2,313.28 |

£ 3,718.52 |

61% |

|

Wheelton |

192 |

41% |

£ 2,141.00 |

£ 3,245.70 |

52% |

|

Whittle-le-Woods |

1355 |

48% |

£ 2,014.33 |

£ 2,902.92 |

44% |

|

Withnell |

537 |

36% |

£ 1,967.07 |

£ 2,786.77 |

42% |

CHORLEY CONSTITUENCY BY COUNCIL WARD

| Wards in Chorley Constituency | Number of Homes across Council tax Bands D to H | % of all Ward homes hit by Labour left plan if implemented | Today's average council tax for homes in the Ward from Band D to Band H | Williamson's plan for Council Tax (Average across Bands D to H) | Average increase for Ward Band D to H |

| Pennine | 692 | 66% | £ 2,028.52 | £ 2,926.48 | 44% |

| Brindle And Hoghton | 557 | 60% | £ 2,108.28 | £ 3,158.39 | 50% |

| Heath Charnock And Rivington | 484 | 52% | £ 2,108.24 | £ 3,148.68 | 49% |

| Clayton-le-Woods And Whittle-le-Woods | 1664 | 45% | £ 1,933.35 | £ 2,692.59 | 39% |

| Astley And Buckshaw | 1323 | 42% | £ 1,890.88 | £ 2,573.76 | 36% |

| Clayton-le-Woods West And Cuerden | 933 | 42% | £ 1,942.98 | £ 2,709.47 | 39% |

| Euxton North | 767 | 40% | £ 1,942.63 | £ 2,713.27 | 40% |

| Chisnall | 659 | 37% | £ 1,965.16 | £ 2,783.33 | 42% |

| Wheelton And Withnell | 648 | 35% | £ 1,987.26 | £ 2,837.00 | 43% |

| Euxton South | 459 | 27% | £ 1,962.02 | £ 2,762.00 | 41% |

| Adlington And Anderton | 793 | 23% | £ 1,960.82 | £ 2,751.03 | 40% |

| Chorley South East | 789 | 22% | £ 1,870.90 | £ 2,518.94 | 35% |

| Chorley North West | 580 | 21% | £ 1,854.25 | £ 2,489.41 | 34% |

| Chorley South West | 724 | 19% | £ 1,821.73 | £ 2,393.19 | 31% |

| Clayton-le-Woods North | 528 | 17% | £ 1,892.48 | £ 2,579.77 | 36% |

| Chorley North East | 415 | 14% | £ 1,827.26 | £ 2,413.94 | 32% |

| Coppull | 361 | 12% | £ 1,806.57 | £ 2,373.40 | 31% |

| Chorley East | 378 | 11% | £ 1,821.34 | £ 2,409.28 | 32% |